Gallery

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |

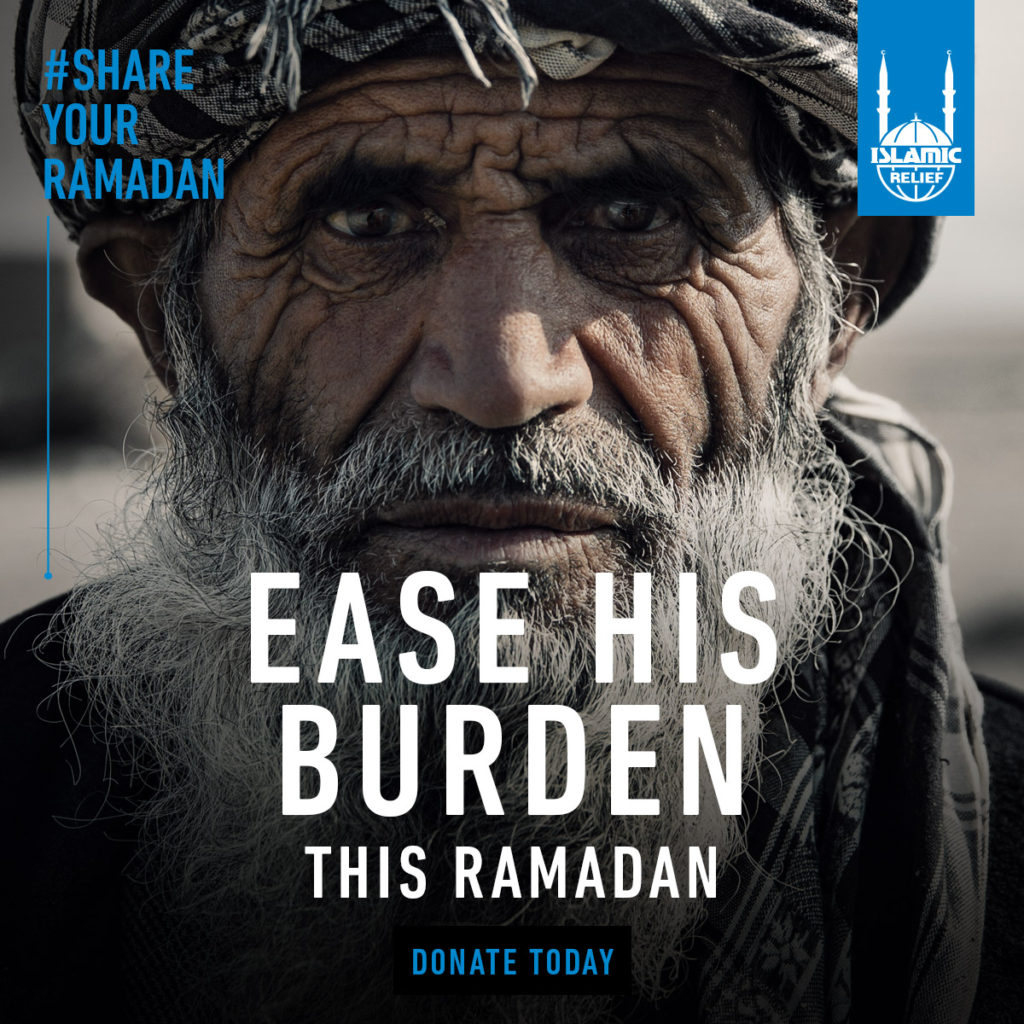

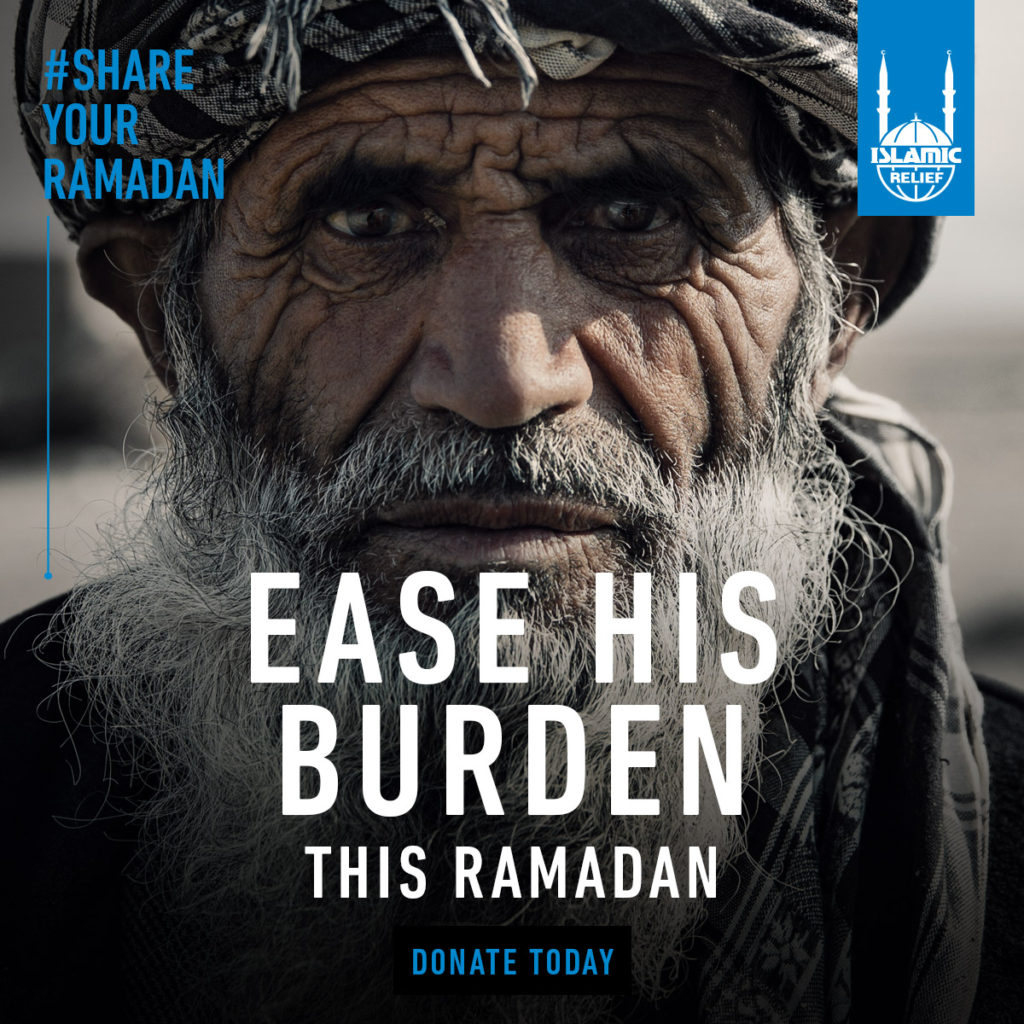

Next, let’s look at the amounts required by zakat al-fitr compared to zakat. Usually, the amount of zakat al-fitr is very small, equating to two to three kilograms of staple food. Zakat, on the other hand, can be much larger because it’s based on 2.5% of a Muslim’s total net worth. There is no specific time frame for when to pay Zakat, though many Muslims choose to make their donation during Ramadan to gain extra blessings. Who Can You Give Zakat To? Allah (SWT) has specified eight categories of eligible recipients for Zakat: The wayfarer – travellers in need. Zakat al-Fitr, or the Zakat of Breaking the Fast of Ramadan, is the special obligatory alms paid by all Muslims at the end of the Ramadan fasting month. To calculate Zakat al-Fitr for Ramadan 2025, you need to determine the cost of a basic food item in your locality, such as rice, wheat, barley, dates, or raisins. Once you have this information, you’ll also need to know the number of individuals living in your household. Zakat is a Pillar of Islam to purify your wealth for Allah’s (SWT) will. Zakat Calculator #currentYear# helps you calculate and find your payable Zakat amount for the year. Many people choose to pay their Zakat al Fitr and Zakat during Ramadan because of the increased reward. Zakat is a mandatory charity —2.5% of eligible wealth—to support those facing poverty, hunger, and crisis. It is a spiritual obligation and a path to barakah (blessings) in this life and the hereafter. Your Zakat in Action: Where to give your Zakat Ramadan Food Parcel Distribution – Bamako, Mali. Choosing where to give Zakat is important Does Zakat Have to be Paid in Ramadan? Zakat in Ramadan is one of the most discussed topics. According to the principles of the Islamic faith, Zakat has to be paid as soon as it becomes compulsory. Zakat becomes obligatory when one Hijri year has passed on the wealth in one’s possession. The scholars warn against delaying the payment of Zakat To give the right amount of zakat, you need to calculate it as a percentage of your total wealth. Our helpful online zakat calculator will make it much quicker to work out your zakat donation, and how much to give to charity. It's important to first state there is a minimum amount of wealth a Muslim must have before paying zakat, and this is called the nisab. It's based on the value of 87.48 grams of gold or 612.36 Zakat, one of the five pillars of Islam, is obligatory on all Muslims who meet the Nisab values. Nisab is the minimum amount of net capital that a Muslim must possess in order to be eligible to pay Zakat. The Nisab value based on gold $7,770 (as estimated on February 1, 2025) Calculating your Zakat amount is a simple process with our calculator. Zakat donations help Embrace Relief provide shelter, education, and health care to orphaned children, giving them a chance for a brighter future. The Spiritual Rewards of Giving Zakat in Ramadan. Giving Zakat during Ramadan holds special spiritual significance. It is believed that good deeds performed during this holy month are multiplied in The obligation of Zakat is not directly related to Ramadan, but rather the requirement and payment of Zakat is linked to becoming the owner of its specified nisab (minimum amount of Zakat). Like other forms of worship, Zakat is also an important act of worship, and the rewards for all acts of worship are increased during Ramadan. The Zakat-ul-Fitr amount for this year is $15 per family member. Zakat-ul-Fitr is obligatory and must be paid before Eid Salah. Click the link below to be directed to the Zakat donation page. The Federal Ministry of Poverty Alleviation and Social Protection has officially announced the Zakat threshold for 2025. According to the latest notification, Zakat will be deducted from bank accounts on 1st Ramadan 1446 Hijri, if the account balance meets or exceeds the prescribed limit. Zakat – Obligatory charity given from one’s wealth to support those in need. Giving Zakat during Ramadan carries even greater rewards. Sawm – Fasting during Ramadan, an act of self-discipline, devotion, and reflection. Those in good health and a sound mind are required to observe it, with exceptions for those unable to fast. ISLAMABAD: The Federal Ministry of Poverty Alleviation and Social Protection has issued the Zakat Nisab for the year 2025 in Pakistan. The Ministry of Poverty Alleviation and Social Protection has sent a letter to banks, according to which, if your account has an amount of Rs. 179,689 or more on the first day of Ramadan, then Zakat will be deducted. Zakat Meaning: "Zakat" is an Arabic word that means "giving to the needy" or "giving to charity". How does Zakat Work? Muslims who own wealth above a certain amount, known as the nisab, must pay Zakat. The Zakat rate is 2.5% of the amount of wealth above the nisab. Zakat is paid once a year after the lunar (Islamic) year has passed. No deduction of Zakat at source shall be made, in case the amount standing to the credit of an account in respect of the assets mentioned in column 2 of Serial No.1 of the first schedule of Zakat This will then give you the total amount of Zakat owed. Zakat Scholar: Providing specialist advice. We understand that calculating your Zakat can be daunting, and even confusing. Therefore, we work with a dedicated Zakat scholar during Ramadan to provide a specialised advice service. This service allows you to speak directly to a learned Elevate your Ramadan experience in 2025 by seamlessly paying Ramadan Charity as a Sadaqah and Zakat online in the US & UK. Email: sapa@sapa-usa.org Phone: +1 (888) 472-7287

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |