Gallery

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |

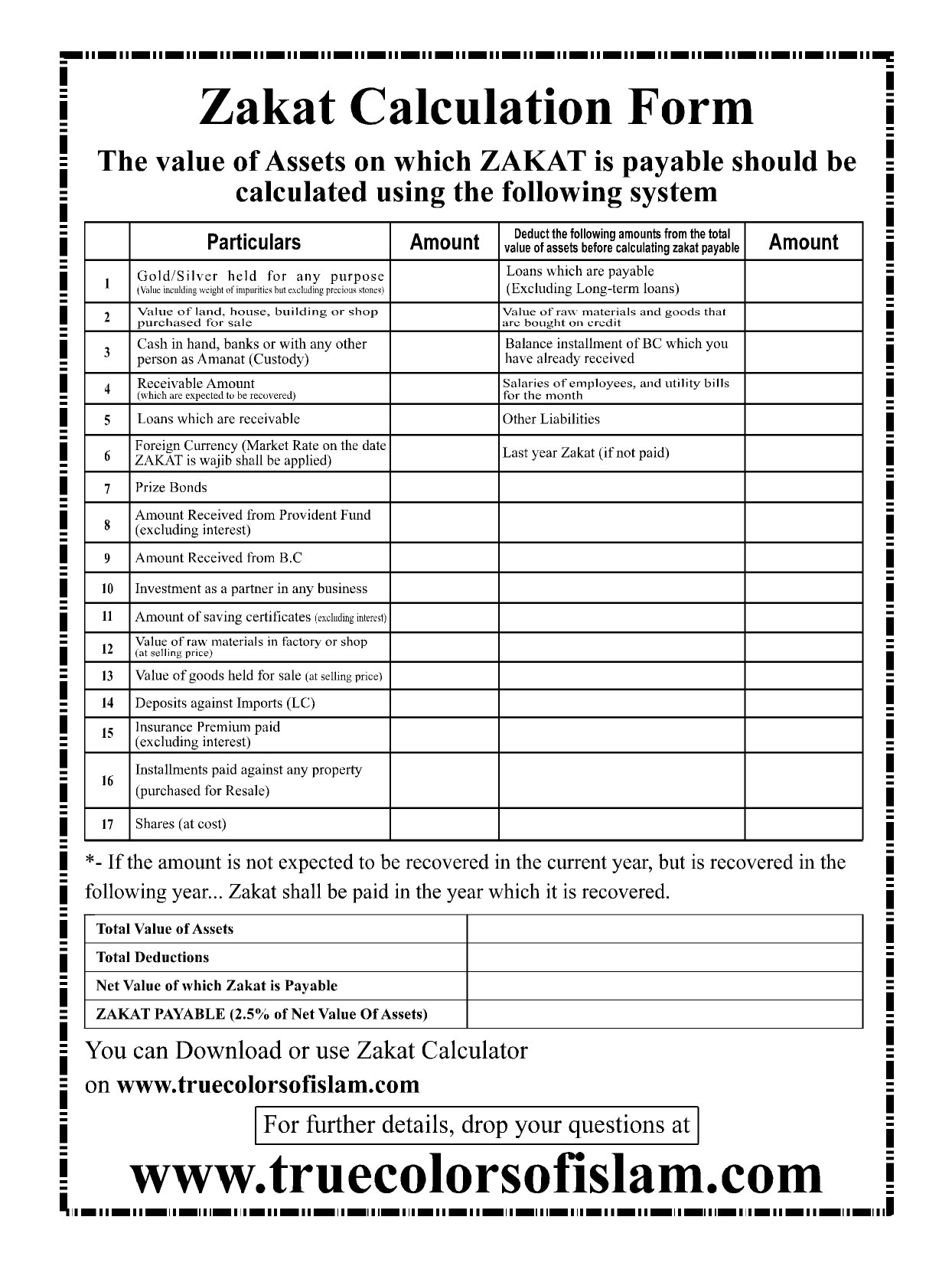

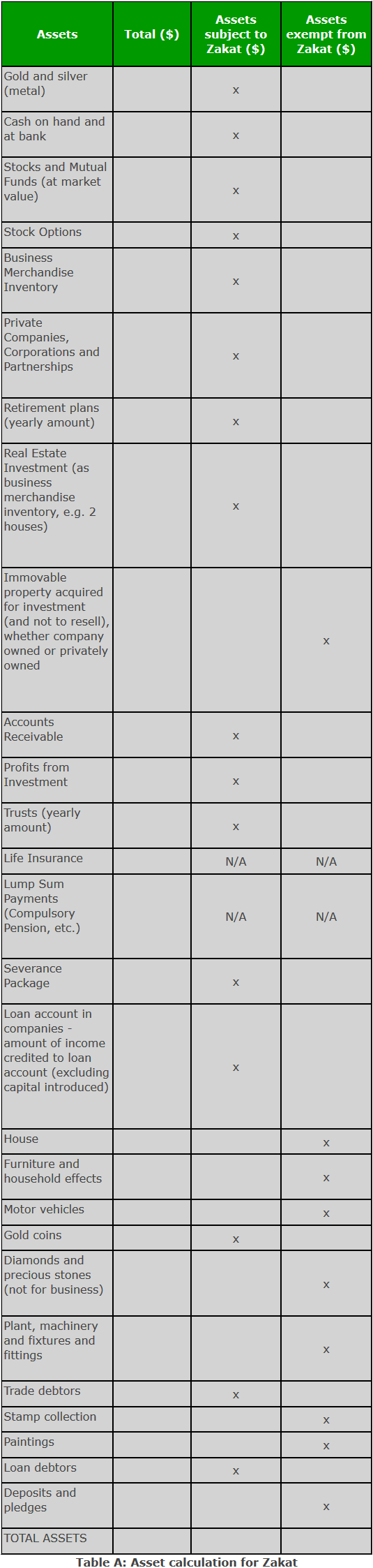

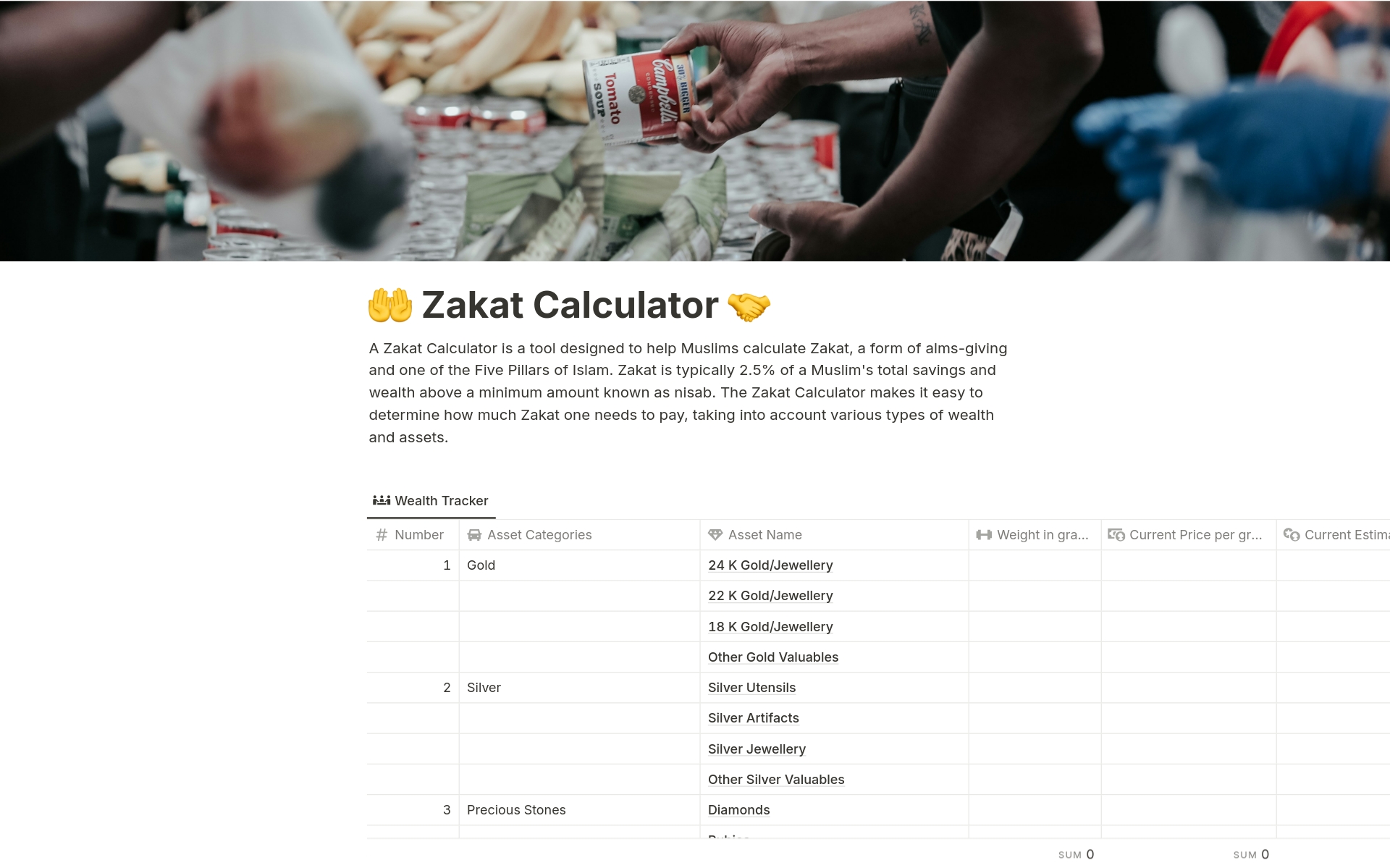

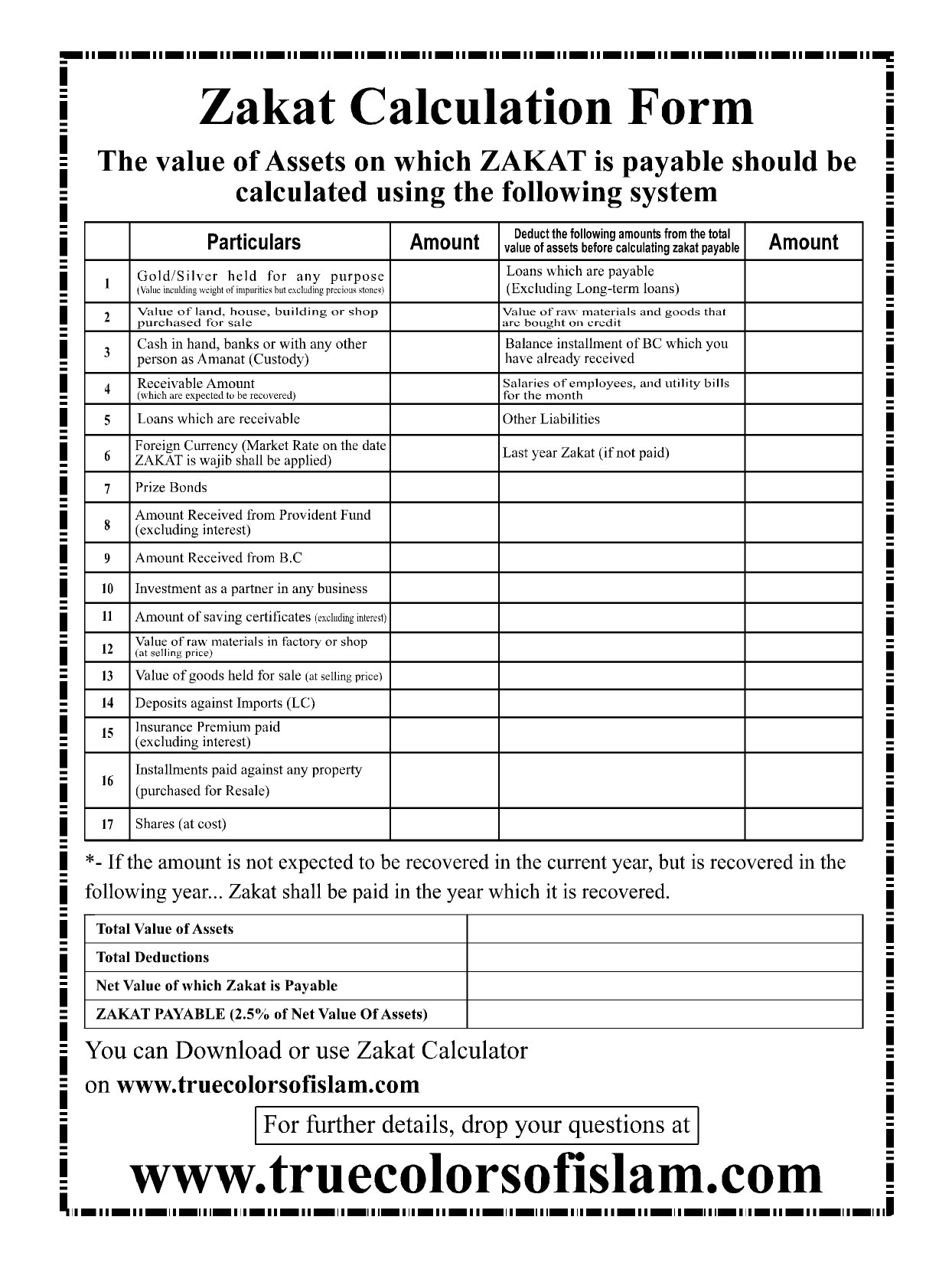

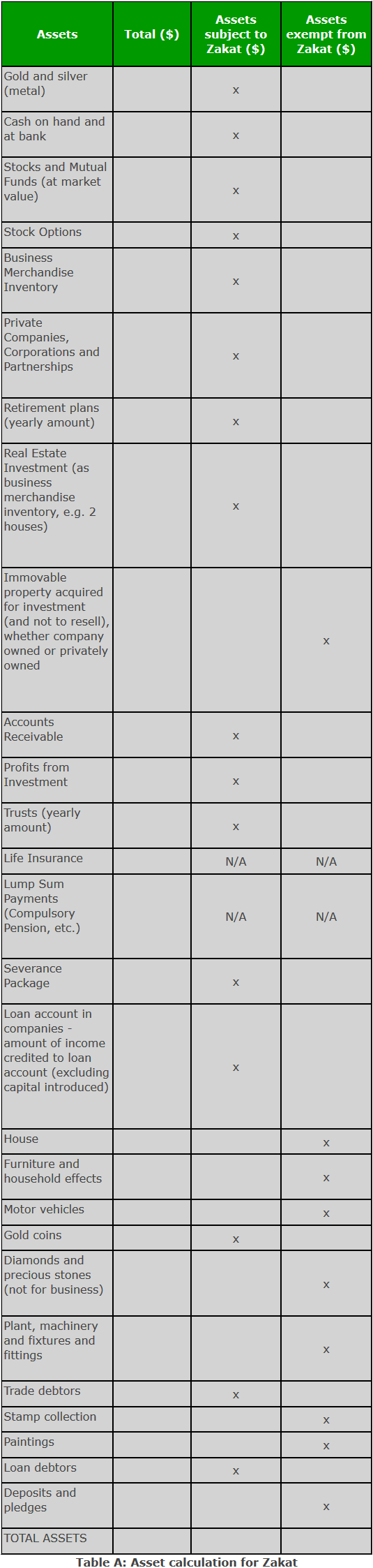

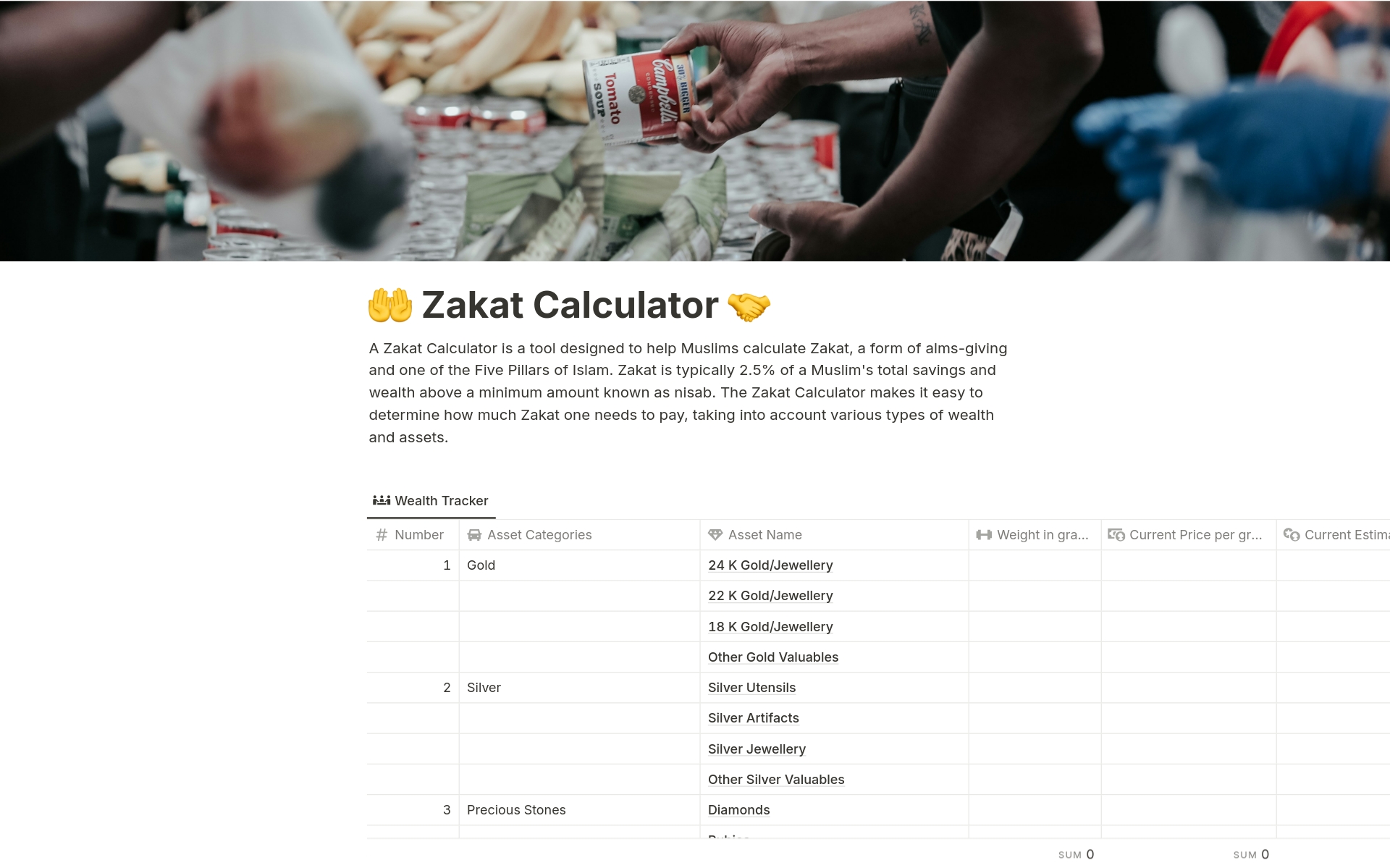

As a first step towards ascertaining Zakat liability, please determine your Zakat Due Date. It can be 1st Ramzan, 21st Ramzan, 1st Moharrum or any other convenient date of lunar calendar. Once fixed, it remains same year after year. Track your assets and calculate Zakat effortlessly with Halalfolio. Manage gold, silver, cash, stocks, and real estate in one place with Islamic finance compliance. Our Zakat Calculator India is an essential tool designed to help Muslims accurately determine their Zakat obligations. It simplifies the process by assessing total wealth, liabilities, and applicable Nisab values based on gold, silver, and other financial assets. Zakat Calculator #currentYear# helps you calculate and find your payable Zakat amount for the year. Many people choose to pay their Zakat al Fitr and Zakat during Ramadan because of the increased reward. How many types of Zakat? Zakat al-Fitr is also referred to as ‘Fitrana’, it is a donation before the Eid al-Fitr prayer at the end of Ramadan. The purpose of Zakat al-Fitr is to enable poor people to celebrate Eid. Zakat al-Mal is also known as 'Zakat on wealth' or 'alms-giving'. An annual obligation is to give a portion of wealth including Whether you're calculating Zakat on investments, precious metals, or business assets, our calculator provides precise figures aligned with Shariah requirements. Comprehensive guide to Zakat with Quranic verses, authentic Hadiths, and eligibility criteria. Calculating Zakat is now easier than ever with our comprehensive tools, including a Zakat calculator on gold and other assets. How to Calculate Zakat? Giving Zakat is a religious obligation for all eligible Muslims and is based on the current nisab values. Updated online Zakat Calculator in Rupees. Easily calculate your zakat based on nisab of Gold. Zakat Center India. Use Alkhidmat's simple Zakat Calculator 2025 to determine your zakat obligation accurately. Just input your financial details, such as zakat on gold, silver, or current accounts, and the calculator will guide you based on the Zakat Nisab. This user-friendly tool ensures your zakat deduction is calculated according to Islamic principles, with the zakat percentage applied correctly. Conveniently Business partnership assets on which Zakat is to be calculated. Trending News: zakat sadaqahzakat ramadanzakat paymentszakat paymentzakat onlinezakat on propertyzakat on cashzakat nisab 2024zakat meaning in islamzakat calculator pakistanzakat 100 donation policywho qualifies for zakatwateraid zakatsadaqah zakatmuslim hands zakati need zakat helphow to calculate zakat on savingseligibility for zakateid zakatdefinition of zakatdefine zakatzakat vs This Zakat Calculator has been designed in consultation with the faculty of Islamic law at Zaytuna College. It calculates your zakat based on the legal school of your choice: Hanafi, Maliki, or Shafi’i. 1. To begin, pick a nisab 2 standard that you prefer to use (gold or silver) 3 as well as your preferred legal school. Calculate Your Zakat With Our Easy To Use Calculator. Current Nisab Value (2025) Silver Nisab (612.36g): £492 and $602. Gold Nisab (87.48g): £6203 and $7590 How to Calculate Ramadan Zakat? We are here to guide you on How to Calculate Zakat. First, calculate Nisab which is 39198 PKR for this year as per the Pakistan Government. Determine the net worth of zakat by subtracting liabilities from zakat-able assets. Compare the net worth of Zakat with Nisab. Trending News: zakat sadaqahzakat ramadanzakat paymentszakat paymentzakat onlinezakat on propertyzakat on cashzakat nisab 2024zakat meaning in islamzakat calculator pakistanzakat 100 donation policywho qualifies for zakatwateraid zakatsadaqah zakatmuslim hands zakati need zakat helphow to calculate zakat on savingseligibility for zakateid zakatdefinition of zakatdefine zakatzakat vs Trending News: zakat sadaqahzakat ramadanzakat paymentszakat paymentzakat onlinezakat on propertyzakat on cashzakat nisab 2024zakat meaning in islamzakat calculator pakistanzakat 100 donation policywho qualifies for zakatwateraid zakatsadaqah zakatmuslim hands zakati need zakat helphow to calculate zakat on savingseligibility for zakateid zakatdefinition of zakatdefine zakatzakat vs Across the world, your Zakat and sadaqah gifts are providing life-saving iftar meals every single Ramadan day. These photos show your Ramadan gifts, which were delivered to India with love and care. When is Zakat due date? Zakat is due after one Lunar (Hijri) year starting from either the first day you acquired the amount of Nisab or the day you paid Zakat last year. The month of Ramadan is considered to be the best time to pay Zakat. We urge you dear brother/sister to calculate your Zakat now and to pay it as soon as possible Trending News: zakat sadaqahzakat ramadanzakat paymentszakat paymentzakat onlinezakat on propertyzakat on cashzakat nisab 2024zakat meaning in islamzakat calculator pakistanzakat 100 donation policywho qualifies for zakatwateraid zakatsadaqah zakatmuslim hands zakati need zakat helphow to calculate zakat on savingseligibility for zakateid zakatdefinition of zakatdefine zakatzakat vs Zakat al-Fitr, also known as Zakat al-Fitr, is a form of alms-giving that is mandatory for Muslims who have the financial means to do so. This form of charity is specifically prescribed for the occasion of Eid al-Fitr, which marks the end of Ramadan, the holy month of fasting for Muslims.

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |