Gallery

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |

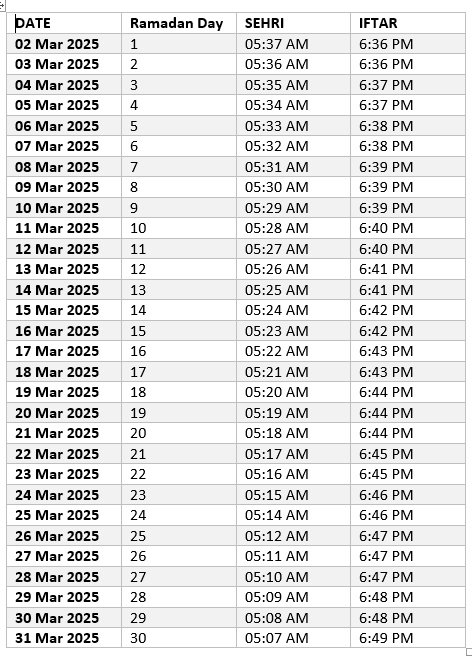

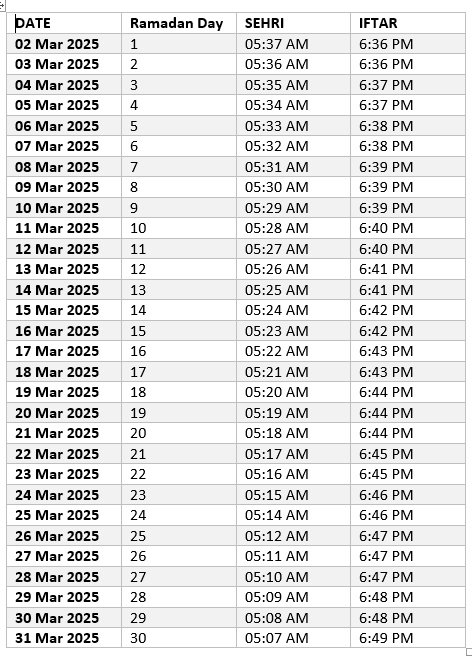

Zakat is a mandatory charity —2.5% of eligible wealth—to support those facing poverty, hunger, and crisis. It is a spiritual obligation and a path to barakah (blessings) in this life and the hereafter. Your Zakat in Action: Where to give your Zakat Ramadan Food Parcel Distribution – Bamako, Mali. Choosing where to give Zakat is important Zakat refers to two types: Zakat-al-Mal and Zakat-al-Fitr. Zakat-al-Mal is the obligatory annual payment that can be made at any time. However, Zakat-al-Fitr (Fitrana) must be made during Ramadan, ahead of the Eid prayer. Experience the blessings of Ramadan with Zakat Foundation. Give Zakat al-Fitr, support those in need, and make a difference this holy month. Foster community and spread generosity today. This comprehensive daily Ramadan Duas list, divided into three stages corresponding to the three Ashras (ten-day Ramadan is a time for Muslims to strengthen their connection with Allah T’alā (SWT) through prayer, supplication, and acts of charity and zakat. There are seven duas that many of our sages recommend for us to make repeatedly in Ramadan. These are based on the Quran and the practice of the Prophet, on him be peace, only one of which is specified for a particular time in Ramadan. Zakat al-fitr (fitrana) is a sacred charity required by all Muslims who have excess food so that the poor and needy can share in the celebration of the end of the Ramadan fast. Masjids and Islamic charities can make it easy for the ummah to give their zakat al-fitr in 2025 and beyond using modern and easy online and in-person giving options. Ramadan is one of the most blessed times for a Muslim to give their zakat and receive even more blessings for their charity. But how much zakat do you owe for Ramadan 2023? Here’s how you can calculate and pay your zakat in Ramadan 2023: 1. List Your Zakatable Wealth. The wealth a Muslim possesses on which zakat is due is: We are here to guide you on How to Calculate Zakat. First, calculate Nisab which is 39198 PKR for this year as per the Pakistan Government. Determine the net worth of zakat by subtracting liabilities from zakat-able assets. Compare the net worth of Zakat with Nisab. This article discusses giving Zakat during Ramadan and explains the allowable threshold (nisab) for Zakat. It also describes the value of the nisab. Zakat in Ramadan is one of the most discussed topics. According to the principles of the Islamic faith, Zakat has to be paid as soon as it becomes compulsory. Zakat becomes obligatory when one Hijri year has passed on the wealth in one’s possession. Daily Ramadan To-Do List Your Ultimate Ramadan Routine. To ensure a productive Ramadan, follow this daily to-do list: Wake up for Suhoor – Eat a nutritious meal and hydrate well. Pray Fajr – Stay awake for morning Dhikr and Quran recitation. Perform Dhikr and Morning Du’as – Begin your day with gratitude and reflection. Zakat Ramadan, Ramadan And Zakat, Zakat In Ramadan January 21, 2025 Zakat In quran, Zakat And Quran, Beneficiaries Of Zakat January 14, 2025 Zakat On Gold, Zakat On Silver, Silver Nisab, Gold nisab January 20, 2025 Zakat In Islam, Importance Of Zakat, Who Is Eligible For Zakat January 16, 2025 Meaning Of zakat, Definition Of Zakat In Islam The Short Answer. Zakat al-Fitr, or the Zakat of Breaking the Fast of Ramadan, is the special obligatory alms paid by all Muslims at the end of the Ramadan fasting month.. It is also called Sadaqat al-Fitr, “the Charity of Breaking the Fast” of Ramadan, and Zakat al-Fitrah, the Alms of Human Nature, or the Human Creation, because it is a mandatory charity due on every Muslim at the end of 14. Zakat Contribution & Awareness Program. Zakat is an essential aspect of Ramadan where Muslims give a portion of their wealth to those in need. Many employees may have questions about how to calculate Zakat and where to contribute. Companies can support employees by: Inviting financial experts or religious scholars to explain the principles Ramadan is a month of profound spiritual significance, and the practice of reciting duas plays a pivotal role in the observance of this holy month. As we navigate through Ramadan, let us remember the power of dua and the promise of Allah to respond to His servants when they call upon Him. The Quran specifies eight categories of beneficiaries, from the poor to those in debt. Think of it as delivering aid where it’s needed most, ensuring your Zakat makes a real difference. 5. Timing Your Zakat Payment. While Zakat can be paid any time during the lunar year, paying during Ramadan ensures your contribution is especially blessed. 6. Giving List: Automate Your Daily Ramadan Giving. Your daily Ramadan donations will go to fundraisers in your Giving List, in the order they’re listed. If your list is empty, we’ll automatically select a featured LaunchGood fundraiser for you. You'll receive an email receipt each day, showing the fundraiser you supported. The Messenger of Allah, peace be upon him, said: “Islam is built upon five pillars: the testimony that there is no god but Allah, and that Muhammad is His servant and Messenger, the establishment of prayer, the giving of alms (zakat), the pilgrimage to the House (Hajj), and fasting during Ramadan.” [Sahih Muslim: 16] Prepare for Ramadan 2025 with our downloadable timetable. Join our Special Ramadan Programs, supporting impoverished families through food packs and providing Suhur and Iftar for orphaned children. Zakat al-Fitr calculations are different from zakat donations, which usually refer to donations for Zakat al-Mal. Zakat al-Mal comes from Muslims with a certain amount of wealth, who must give away 2.5% of their liquid assets to charity every year. Zakat al-Mal applies to currency, gold, silver, and property, and is only a requirement if you

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |