Gallery

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |

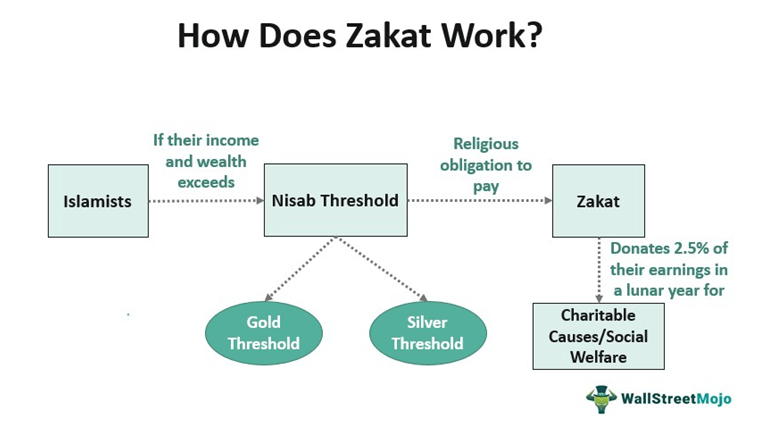

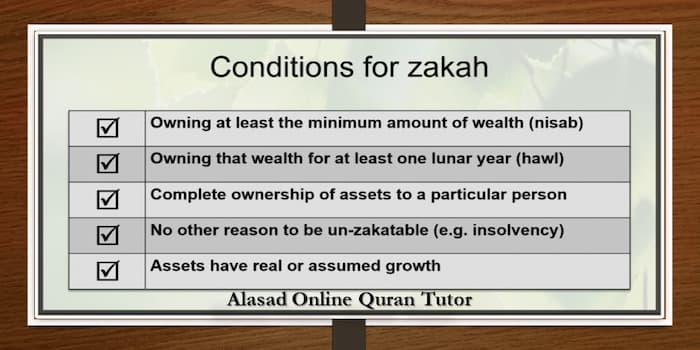

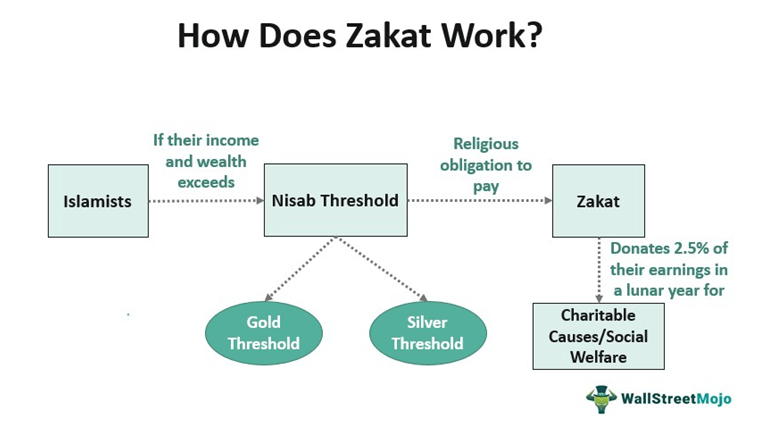

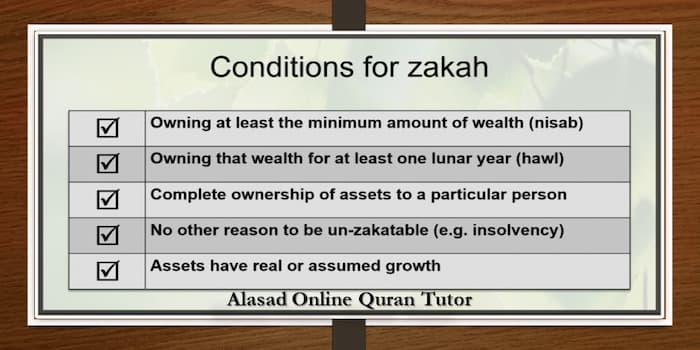

Zakat Percentage – How Much Zakat to Pay. Your Zakat donation should amount to 2.5% of your total wealth accumulated over the year. As an example, if your total assets (after any debts owed) amounted to £10,000, then you would be required to pay £250 as Zakat. What does Zakat apply to? According to Islamic guidelines, every adult Muslim who meets the Nisab threshold is obligated to give Zakat. Zakat in Ramadan: What It Is and Why It Matters. Zakat is a mandatory charity—2.5% of eligible wealth—to support those facing poverty, hunger, and crisis. Zakat is calculated on the amount that is in a person’s possession after one lunar year has passed. It is calculated at the rate of 2.5 percent of the total wealth or money. To work out your Zakat, use Muslim Aid’s Zakat calculator. The payable zakat is 2.5% of your overall possessions. You will also have the option to print this summary to keep a record of paid Zakat every year. Another type of Zakat that is Wajib (compulsory) on Muslims is Zakah al-Fitr , often referred to as Sadaqah al-Fitr. To give the right amount of zakat, you need to calculate it as a percentage of your total wealth. Our helpful online zakat calculator will make it much quicker to work out your zakat donation, and how much to give to charity. Q: Is Zakat paid only in Ramadan? Ans: No, You can pay Zakat in any month. Q: How much is Zakat Percentage? Ans: It is 2.5% on all assets. You can calculate your zakat in 2025 by using Islamic Relief’s quick and easy-to-use Zakat Calculator. Eligible Muslims pay zakat once a year, and it is due as soon as one lunar (Islamic) year has passed since meeting or exceeding the nisab (certain amount of wealth). You can calculate your Zakat in 2025 by using Islamic Relief’s quick and easy-to-use Zakat calculator. Eligible Muslims pay Zakat once a year, and it is due as soon as one lunar (Islamic) year has passed since meeting or exceeding the nisab (certain amount of wealth). Enter all assets which have been in your possession for one lunar year. Zakah is payable at 2.5% of your wealth which has reached the minimum threshold of nisab. As of March 29, 2022 the gold nisab is roughly $5,763. Zakat, one of the five pillars of Islam, is obligatory on all Muslims who meet the Nisab values. Nisab is the minimum amount of net capital that a Muslim must possess in order to be eligible to pay Zakat. The Nisab value based on gold $7,770 (as estimated on February 1, 2025) Calculating your Zakat amount is a simple process with our calculator. Each type of eligible wealth has a Zakat percentage. A 2.5% rate is assessed on all surplus personal and business wealth. Agricultural produce has a 5% or 10% Zakat rate, depending on natural watering or irrigation of crops. Livestock is gauged at itemized in-kind rates. Zakat Foundation uses 100 percent of your Zakat offering for Zakat eligible causes, reaching the most needful people in the world, at home and abroad. Last year, we used 11 cents per dollar on average as designated Zakat administrators working to collect and distribute your Zakat directly to the world’s impoverished, war-ravaged, and disaster Zakat is payable on all grazing animals, like goats, sheep, camel, cows and buffaloes. Zakat on animals is payable every year, provided that the stock exceeds the threshold of Zakat. Also, such animals should be of the type that grazes naturally. In the case of sheep and goats, the minimum threshold is 40, when one sheep is due. Zakat ul-Fitr is different from Zakat as this is a donation that’s made before the Eid prayer at the end of Ramadan. The donation must be made beforehand so that those in need can receive it in time for Eid to be able to celebrate it properly. The Zakat ul-Fitr payment is equivalent to one ‘saa’ (3kg) of a common staple food in your country. Both Zakat al-Fitr and Zakat al-Mal embody the Islamic principles of empathy, generosity, and social welfare. While Zakat al-Fitr is more about ensuring communal participation and happiness during Eid, Zakat al-Mal focuses on the broader redistribution of wealth and reducing economic disparities. As for an exact date for when Zakat is due, this varies for each individual as it all depends on when a Muslim has exceeded the Nisab threshold. With that said many believers like to give their Zakat during the Holy month of Ramadan for added blessings. The Zakat percentage stays the same throughout the year, no matter when you need to pay it. It is necessary for him to pay 2.5 percent of his total wealth after a year has passed. Zakat Ramadan, Ramadan And Zakat, Zakat In Ramadan January 21, 2025 The Zakat Foundation of America offers our own zakat calculator to help you determine how much zakat you need to pay. Use our Zakat Calculator to calculate your zakat. Sponsor Iftar Meals The Nisab threshold, equivalent to 87.48 grams of gold or 612.36 grams of silver, determines your Zakat obligation. Zakat becomes mandatory if your eligible assets exceed this threshold and have been in your possession for one lunar year (Hawl). Benefits of Digital Zakat Calculation. Using our online Zakat calculator offers several advantages: 100% of your zakat goes directly to refugees in need. With over 130 million refugees experiencing displacement and over 60 percent of refugees coming from Muslim countries, your zakat obligation can transform lives directly through UNHCR. This Ramadan, maximize the power of your zakat with USA for UNHCR to serve refugees and displaced people around the world.

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |